CryptoTrader.Tax Review | One of the First Crypto Tax Reporting Software

Introduction

In 2009, the world’s most valuable cryptocurrency Bitcoin was launched. Soon after the release of BTC, many other digital currencies started rolling out. Over time, there have been questions regarding how these digital currencies are taxed. As the Internal Revenue Service, or IRS, puts it – cryptocurrency is a digital representation of value and is treated as capital taxes. Hence, taxes apply to all types of digital currencies when they are sold at a profit.

What is CryptoTrader.Tax?

CryptoTrader.Tax is one of the first crypto taxes reporting platforms built to make it easier for digital currency traders to prepare and report taxes. There is no doubt about the fact that taxes can be a bit complicated. However, with CryptoTrader.Tax, you get an automated software platform designed to make the tax reporting process convenient and time-saving for you.

What else would you like when online tax crypto software can help you save time and maximize your refund?

If you are an individual cryptocurrency investor, this is one of the best tax reporting platforms you can get considering the features it offers. The crypto tax tool is accurate and reliable as it picks data and generates reports based on your historical data.

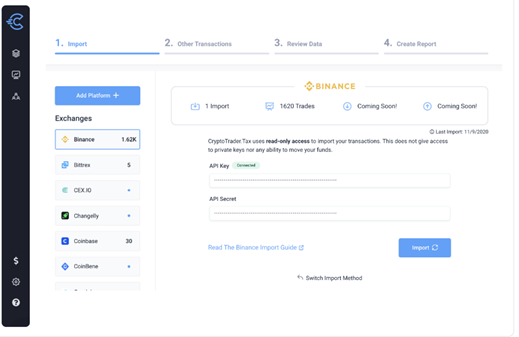

What’s more is that you can easily link numerous crypto exchanges and wallets such as Binance, Coinbase, Bittrex, Exodus, and more. After connecting your preferred exchange(s) and/or wallet(s), you can import the required trading data.

With so many features and offerings, it has truly made crypto tax reporting quick and efficient. CryptoTrader.Tax has made everything hassle-free – all you have to do is link your exchanges and wallets, import all your trading data, and download the required reports to file taxes.

How this crypto-tax Calculator Works?

Filing taxes is easier said than done. However, with CryptoTrader it is easy with its streamlined 4-step process. Here is how you can do it:

Step # 1- Import your trade reports:

After signing up and selecting the required exchange platforms, all you need is to import the tax file or connect your exchange account. This auto-import function is highly sophisticated via crypto-tax API; crypto tax API is a read- only API that doesn’t allow any change to your digital wallet or your funds information.

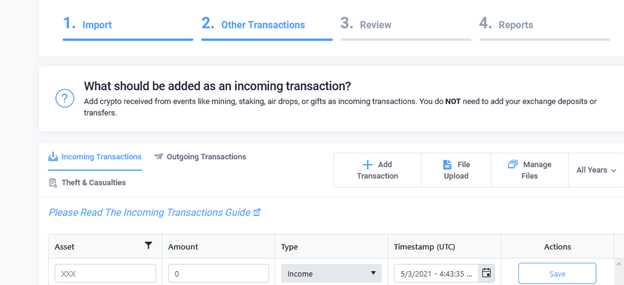

Step # 2- Other transactions:

Add incoming transactions like payments earned through mining, crypto received through gifts or marketing promotions. Here you can also add payments or gifts through outgoing transactions, theft and casualties. Don’t need to worry, if words get a little technical for you. Read step-by-step transaction guide for filling in other transaction details to get accurate numbers for crypto tax.

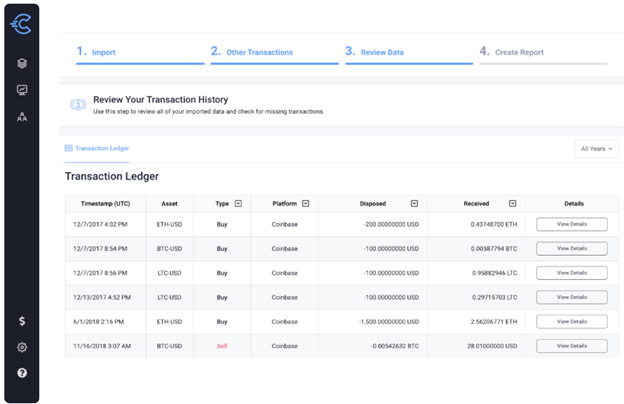

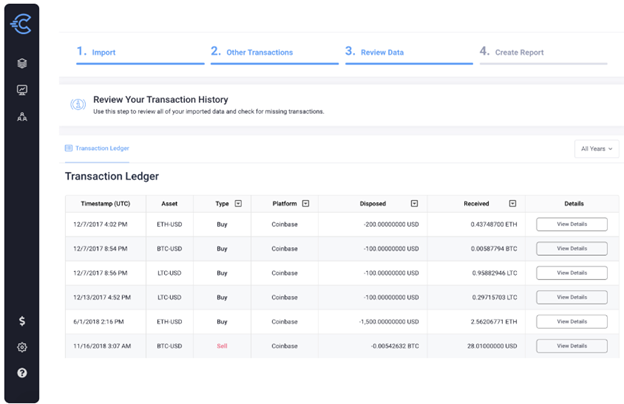

Step # 3- Review data:

After importing all your transactions and trades, review your data thoroughly to make sure there are no inaccuracies. Just click on the Next button and you are ready to view figures and stats without wasting hours on compiling and calculating tax data.

Step # 4- Final Report:

Once all done, get the automated report in a few minutes. The best crypto tax software will give you a detailed outcome based on the net gain or losses earned in a taxable year. You can now file your report tax either by yourself or by asking your accountant to do it on your behalf.

Pricing

You can have four different plans as per your pocket and trading volume. The cheapest of them starts with $49 that is limited to 100 trades with free crypto tax report preview and lot more. Below are the complete details of their pricing plan with core features:

| Plan Type | Hobbyist | Day Traders | High Volume | Unlimited |

| Pricing | $49 | $99 | $199 | $299 |

| Number of Trades | 100 | 1500 | 5,000 | Unlimited trades |

| Core Features, Software integration and tax reports | Yes | Yes | Yes | Yes |

Crypto Tax Reports

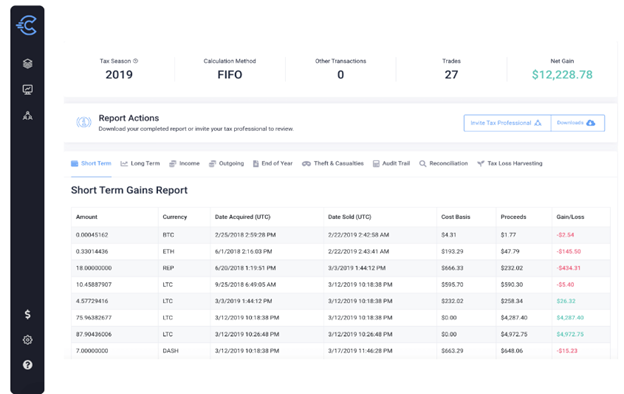

Did you ever think filing taxes, and that too of a digital currency, would be so easy? Cryptotrader automatically generates tax report documents required to file crypto taxes.

- Short & Long Term Gains

This report will give you a detailed break-up of your net gains and loss, purchase price of the asset and gross earnings.

- Cryptocurrency Income Report

This is a brief report of all your cryptocurrency transactions against the FIAT value throughout the year allowing you to file your return easily.

- Audit Trail Report

Get a report that will show how and where your payments are coming. It is a step-by-step record that explains the complete information connected to any crypto transaction.

- Tax Loss Harvesting report

This report can help you to reduce your tax liability. You can view the details of the losses that can be adjusted against the gains; to reduce the crypto tax to be paid in a year.

- IRS Form 8949

CryptoTrader.Tax automatically fills and generates the IRS Form 8949 which you can attach with your yearly tax returns. You do not have to worry about hiring an accountant or CPA to complete this.

Pros of Using CryptoTrader.Tax

Apart from being one of the first crypto tax tools, there are numerous reasons why online traders have preferred this platform over others. Here are some of the pros of this cryptocurrency tax software:

- Easy to Sign Up

According to a report, “88% of online consumers are less likely to return to a site after a bad experience.” CryptoTrader.Tax offers a convenient and seamless signup process so you can get started right away.

- Link Exchanges and Wallets

One of the main reasons online traders choose this crypto tax software is its ability to integrate all major exchanges and wallets. Whether you want to link your Binance or Coinbase account, you can now easily do it by importing your trading data.

- Quick, Secure, and Reliable

That’s right! CryptoTrader.Tax generates your crypto tax reports in minutes. It is a secure and reliable platform that gives precedence to your privacy and security.

- Customer Service

You can get in touch with one of the customer assistants any time you want via email or live chat options. CryptoTrader.Tax also has a help center to get you through the basics that may or may not require assistance.

- File your reports directly using Turbotax and TaxAct

Once you will have your crypto tax report, you can use Turbotax and Taxact software directly from cryptotrader for E- filing your crypto taxable incomes. If you have paid for this integration, you can access this service directly on this platform.

Cons of Using CryptoTrader.Tax

It is more USA centric which means this software doesn’t support certain tax documents that are outside the American border. For example, IRS form 8949 is the requirement for USA citizens for submitting crypto tax returns. This kind of report is not supported in other parts of the world like Europe or Asia.

This software doesn’t support advanced DiFi technologies like crypto staking, mining and yield farming. There is no direct synchro available in the software. users have to insert details manually using CSV templates using google sheets; means more work for the busy traders.

You might consider it a bit costly knowing the fact; it gives access to limited number of exchanges, not very wide international and direct DeFi support.